(Bloomberg) — The U.S. chief of McDonald’s ( MCD ) Corp . says the company is ready for a fight.

Most Read by Bloomberg

And to win, the burger chain is pulling out one of the most powerful weapons in its arsenal: the value meal. It’s all part of an effort to lure penny-pinching customers who have cut back on fast food after flocking to the Golden Arches in recent years.

On June 25, McDonald’s will launch a marketing campaign and a new $5 meal deal, raising the stakes as US restaurants struggle to woo inflation-weary diners.

“We are committed to winning the value war,” said Joe Erlinger, president of McDonald’s US, in an interview with Bloomberg News.

Last month, after Bloomberg News reported on McDonald’s plans for the $5 promotion, competitors hit back with their own deals — and insults.

Burger King’s US president vowed to roll out its $5 meal “before they do,” alluding to McDonald’s in a memo to franchisees. Wendy’s ( WEN ) Co . promoted a $3 breakfast offer and was used on social media to mock its competitors for copying its ideas. Even Starbucks ( SBUX ), known for its expensive Frappuccinos and lattes, said it would offer a $6 breakfast sandwich and coffee combo.

When asked about his opponents, Erlinger smiled and said he’s not obsessed with competition.

As the largest US restaurant chain by sales, he said McDonald’s size and marketing muscle give the $130 billion company an edge over smaller rivals and the ability to cushion any hit to franchisee profits. “Think about our scale,” he said, noting that the additional cost of adding fries and a drink to a sandwich was minimal. The $5 deal includes a McDouble or McChicken sandwich, small fries, four-piece chicken nuggets and a small soft drink.

Franchisees, who run most McDonald’s stores, don’t all agree with that calculation. Many say they’re eager for a value meal that gets customers in the door, but have concerns about people trading up from pricier options like the $9 Big Mac combo.

“There is simply not enough profit to take 30% off for this model to be sustainable,” an independent franchise group said in a message last month to its roughly 1,000 members.

The company said a local $5 promotion in upstate New York has performed well with lower-income consumers while driving additional sales from wealthier customers who buy more than just a $5 meal deal.

For McDonald’s, however, the promotion — which runs for four weeks nationally and longer in markets like Dallas and Las Vegas — isn’t just about boosting sales. The national campaign also aims to dispel the notion that McDonald’s has become too expensive after images of an $18 Big Mac combo meal in Connecticut went viral on social media along with claims that prices have doubled in recent years.

The company’s prices have risen an average of 40% since 2019 to offset rising costs, Erlinger said in a blog post in May. He said the $18 price tag is an anomaly found at just one of the company’s more than 13,700 locations.

That’s cold comfort to customers like Dylan Covington, 33, who lives in Fort Wayne, Indiana and eats at McDonald’s about once a week. The price hikes have prompted him to cut back on his visits to McDonald’s every two or three months. Instead, he said he goes to a local restaurant where he can get a larger sandwich for about the same price.

“McDonald’s was always the cheap option,” Covington said. “Now it’s not even that. I don’t see a reason to go there unless I specifically want a Big Mac.”

Consumer attraction

As prices rose in the U.S., local McDonald’s deals just weren’t doing enough to lure customers like Covington. While the economy is still moving and the unemployment rate remains low, real growth in disposable income in the US has stalled. Americans have depleted much of their pandemic savings and debt is starting to pile up. Eating out has declined and, for many, even fast food restaurants are increasingly reserved for special treatment.

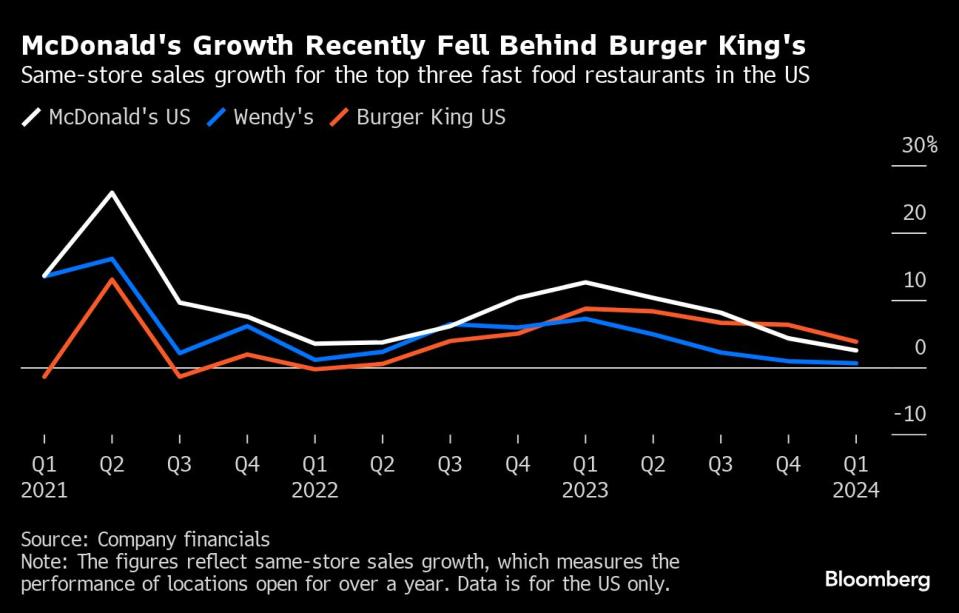

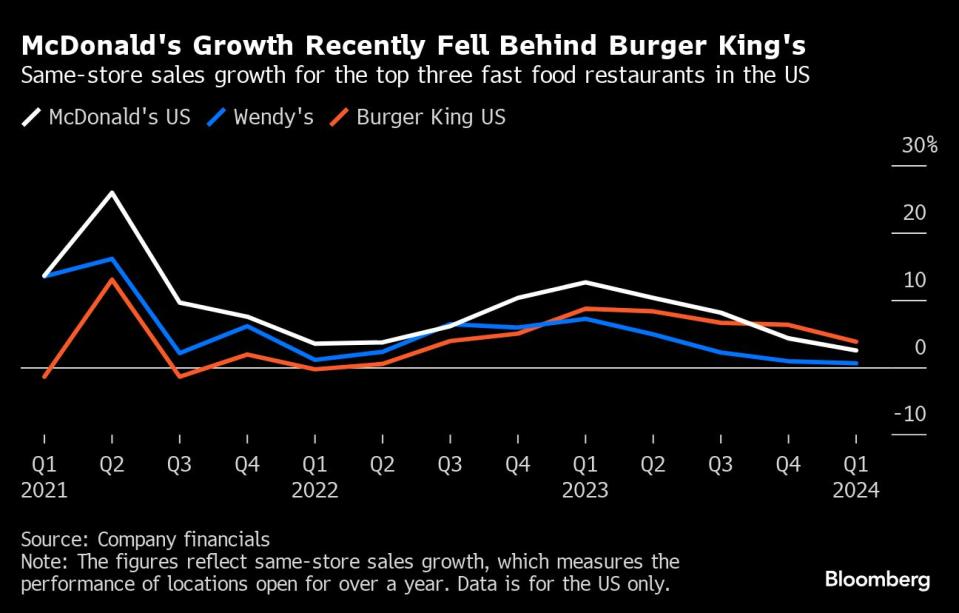

McDonald’s competitors were early to ramp up their value offerings, with Arby’s offering a $6 meal deal in January and White Castle pushing a $5 Bacon Pack in April. McDonald’s sales were initially holding up better than competitors, and the company took a wait-and-see approach.

“It looks like they got caught in their heels in terms of value,” said Sara Senatore, an analyst at Bank of America.

Erlinger said customers are also becoming “more discerning about where they’re spending their dollars.” So the company decided to make a larger national deal for franchisees, who own and operate 95% of the US locations and participate in major marketing campaigns. Operators initially rejected the promotion over profit concerns, but eventually came around, encouraged in part by additional funding provided by the Coca-Cola Co.

McDonald’s is also offering additional promotions such as free fries in front of customers who order through the fast food chain’s app, a key part of the company’s growth strategy. App users order more often and are more likely to add drinks, desserts and other extras that increase check sizes and increase sales.

The $5 meal promotion likely won’t provide an immediate fix. The company’s original dollar menu debuted in 2002, revamping it several times before landing on a $1 to $3 line in 2018. Although the value menu eventually delivered strong results, the initiative took some time to catch on. gaining traction, Chief Executive Officer Chris Kempczinski told investors in April about the 2018 value menu.

Price perception

McDonald’s declined to detail promotional plans beyond this summer, though Erlinger said it’s fair to say the promotion isn’t the last word on the fast-food chain’s worth. “We will definitely remain competitive around value and affordability beyond the $5 meal deal.” Right now, customers aren’t looking for new products or the creativity of McDonald’s chips, burgers or wraps. “They’re looking for value and affordability,” he said.

For their part, competitors say they are ready to go to battle with the restaurant industry’s heavyweights. Patrick Doyle, chairman of Burger King Restaurant Brands International Inc., said the increased focus on value could help support the entire industry.

“There is a perception that maybe prices had gone up a bit too much,” Doyle told investors in mid-June. The value talk is “hopefully it will help perceptions about the category in general – get some people open to coming back.”

Most Read from Bloomberg Businessweek

©2024 Bloomberg LP